They appear to be nearly everywhere. Cool looking hipsters living the dream after making a fortune in the crypto world.

They abound on social media platforms. Even old school glossy magazines, which are barely clinging to life, have dialed in with tall and not-so-true tales of the fabulous riches to be earned in the ether.

They are undeniably real. Those who got in early or built financial structures that facilitate trades that, no one wants to admit, replicate old-style banks and broking houses have amassed unimaginable wealth.

But what about the common folk? How many new crypto traders, for example, lost their life savings last weekend when bitcoin and the crypto universe crashed?

Like pokie addicts and racetrack goers, the wins are extolled while the losses are frequently forgotten.

The allure may be the same; the opportunity to strike it rich big time. However, unlike ordinary gamblers, many crypto devotees have embraced what they believe to be the future of finance with a religious zealotry that shields them from reality.

Bitcoin, which was launched in 2009, was intended to free ordinary citizens from the shackles of government and nation; an alternative, independent, and truly global financial system.

However, more than a decade later, the faithful still cannot, or will not, recognize the ultimate irony. Rather than destabilizing traditional currencies, bitcoin and its 10,000 or so imitators are still priced in them.

The devotees, including the famous and fabulously wealthy, measure their wealth in dollars, yen, pounds, euros, and Australian dollars rather than bitcoins.

Honey, money, money.

We’re all after it. We all require it. However, very few people understand how it works in practice.

Money, even good old-fashioned notes and coins, is a complex and little-understood phenomenon that is based on faith; that it is backed by real wealth and will be redeemed. Even so, competing theories exist about how it works, how it is created, and how it is controlled and manipulated.

It is, at its most basic, a medium of exchange. And it is usually backed, either by the implicit promise of a government or by some other form of wealth storage, such as gold.

Bitcoin was supposed to be an alternative, an island of stability in a sea of nation-based fiat currencies that have been debased and diluted by governments, a system plagued by regular financial crises.

Instead, because it is expensive and slow in transactions, bitcoin has become almost useless as a medium of exchange.

However, it is the extreme volatility that has rendered it completely unusable. Last week, a car dealer who accepted Bitcoin at $US68,000 a fortnight ago would have suffered a massive loss.

And, if the pandemic has taught us anything, it is that it has devolved into a purely speculative, high-risk toy.

Rather than acting as a safe haven in times of crisis, cryptocurrencies amplify the economic wave.

The Bitcoin bubble

They soar in good times and plummet at the first sign of trouble. In the last year, volatility has skyrocketed, transforming cryptocurrencies into a risky and potentially lethal investment.

Global stock and property markets, as shown in the price graph above, have been relatively tame in comparison, despite the fact that interest rates have been cut to zero.

That’s what drew the suited and booted. Wall Street thrives on volatility, and over the last year, investment banks and global fund managers have begun to dabble in the crypto world. Even retail banks, such as the Commonwealth Bank, have encouraged customers to take a chance.

When banks of computers and algorithms enter the trading equation, however, the chances of small-time traders trading their way to glory quickly diminish.

How central banks are about to eat cryptocurrency for lunch

Phil Lowe, governor of the Reserve Bank of Australia, is about as far away from the world of grunge crypto as you can get.

Despite being a long-time critic of cryptocurrency, the RBA, like many other major central banks, has been looking into ways to incorporate the blockchain technology behind cryptocurrencies into its own operations.

Millions of Australians now use digital wallets on their smartphones on a regular basis, and in a speech last Wednesday, Dr Lowe outlined several scenarios in which the RBA may issue and back digital “tokens” similar to Bitcoin and other cryptocurrencies in the same way that it issues banknotes. Even so, given our “efficient, fast, and convenient electronic payments system,” that was a long shot.

That wasn’t the only thing. He then unleashed a bazooka on the cryptocurrency community by revealing that the bank was open to the idea of allowing private players to issue an electronic dollar tied to the Australian dollar for retail users.

But, if that were to happen, it would have to be backed by high-quality assets, such as a bond.

“So, if privately issued stablecoins are ultimately the way things head, it will be crucial they meet very high standards,” he said.

Herein lies the most serious threat to the crypto crew. After failing to seize control of global finance, cryptocurrencies as they currently exist may become obsolete as the world’s largest central banks flip the script and launch their own digital currencies.

Digital currencies may be the “inevitable future of money,” as one major crypto investor puts it, but they are very likely to be run by the same central bank overlords who currently run global finance.

Any privately run currencies or tokens will be heavily regulated and forced to follow the rules.

The Crypto Bubble’s Dangers

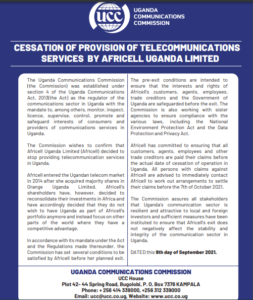

MyCryptoWallet, an Australian-based cryptocurrency exchange, collapsed last week for the second time in as many months, leaving 20,000 investors stranded and likely losing everything. BlockChainGlobal declared bankruptcy in October, owing $23 million.

Investors use these exchanges to trade cryptocurrencies and typically leave their investment with the exchange for safekeeping. The alternative is to keep it on your own hard drive or other form of technology, which can fail, be lost, or be forgotten.

The total market capitalization of cryptocurrencies has now surpassed $US3 trillion.

This excludes the nefarious world of NFTs, or non-fungible tokens, which can be used to purchase anything from art to fictitious real estate and livestock. You can even set up your fictitious paddocks to agist fictitious horses for good returns!

If the whole thing falls apart, the losses will be far from fictitious.

Also Read:

Flex D’Paper’s Debut Album, ‘Kampala Boy,’ is Out Now

Nyashinski, a Kenyan Singer, Marries His Girlfriend Zia Bett

Cindy Sanyu and Prynce Joel Okuyo Atiku Make Their Way Down the Aisle

A Pass Advises DJs Not To Accept Money From Unexperienced Artists To Play Their Music

Azawi Releases New visuals For Party Mood | Video

It’s no surprise that central banks and governments are nervous and attempting, albeit belatedly, to rein in the entire phenomenon. Over 20 countries, including China, have banned bitcoin, and many more, including Australia, are considering regulations.

There could be serious real-world economic consequences if the value of these markets falls precipitously. However, because they operate outside of the system, there is no safety mechanism or possibility of a bailout.

With rising interest rates sending shivers through high-risk asset markets, a shake-out in these overhyped, overvalued, and overweight markets appears almost certain.

And the consequences could be far more severe than anyone anticipates.